Commercial Real Estate Services in Greater Montreal area and the other regions, Canada!

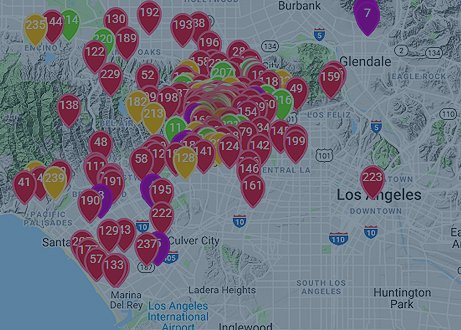

Are you looking for a commercial real estate or business in the Montreal area and other regions? Then you have come to the right place as we offer commercial real estate services in the greater Montreal and surrounding areas and have helped owners, investors and occupiers with every aspect of their real estate needs.

If you have newly immigrated to Canada, we can help you find a Home, Business or Mortgage. In fact, according to your situation:

“Canada makes it easier for a new immigrant to get a mortgage than someone who is already established here.”

I can offer a free market evaluation of your home and business. We can help you save thousands of dollars by making sure that you get the best deal.

As professional commercial realtors, we know the communities and industry inside-out. Whether you are a landlord, investor, occupier or developer, when you choose us you get a “one-stop-shop” for of all your real estate needs. You can go from property search and selection to project and facility management, and finally to evaluation and appraisal. We provide a full set of commercial real estate services to fulfill even your most complex requirements.

What is rental yield?

Rental yield is defined as the rate or percentage of returns from the rental investment property. An investor is likely to achieve a property through rent. It is a percentage figure, calculated by taking the yearly rental income of a property and dividing it by the total amount that has been invested in that property. Real estate brokers and sellers often calculate the yield before they put the property on sale in the market.

There are two ways to look at rental yield: Gross rental yield and Net rental yield.

- Gross yield = (Annual rental income/ Property value) x 100

- Net Rental Yield = [(Annual rental income – Annual expenses) / (Total property cost)] x 100

Rental Return: An Example Calculation: So as a theoretical yield example:

Gross yield: Let’s say that the property was bought for $400,000 and needed a further $50,000 spent on refurbishments.

If we want to buy a rental/investment property in order to generate annual rental income, which is being rented out at $3,000 per month, this will give a yearly rental income of ($3000 X 12) = $36,000.

In this example, the calculation for rental return would look like this:

[$36,000 ÷ ($400,000 + $50,000)] x 100 = 8 %

The rental yield, in this case, would be 8 percent

- Net rental yield = [(Annual rental income – Annual expenses) / Total property cost] x 100

Net Rental Yield: Again, for a property of $450,000 ($400,000 + $50,000) where the annual rental income is $36,000 and the annual expenses are $8,000, the net rental yield would be 6.2 per cent.

[($36,000 – 8,000) = $28,000 ÷ ($400,000 + $50,000)] x 100 = 6.2 %

What Is A Good Rental Yield?

In our experience, a good rental yield for buying in order to let (rent) property is 8% or more. Anything under that and there might not be enough cash-flow in the property to cover running costs, mortgage payments and those unforeseen, expensive problems that sometimes crop up when you invest in a property.

In addition to our experience in selling and leasing commercial properties, we are also specialized in office, retail, industrial, land and investment. Our service is complemented by the ability to deliver unmatched research, relationship and expertise for our client.

We can find businesses, multi-family properties, land, agricultural properties, office space, retail space as well as hospitality and industrial investment opportunities for you– across Canada.

Whether you are looking for a new space for your business, a ready-to-sell or to lease your commercial property, we can do it for you. Our commercial real estate team will provide you with the complete package of services needed for all commercial and industrial sale and leasing transactions.

No project is too big or small. We provide quality analysis and transaction advice in the following service areas:

- Commercial Sales & Leasing

- Investment Sales

- Industrial Sales & Leasing

- Land and Project Development

Commercial property: Multiplex Apartment Building / Multi-Family Units, Strip Mall / Shopping Mall, Plaza & Investment Property, Land, etc.

Bank foreclosure property: Bank Repossession / Foreclosure Property.

Business: Oil / Gas Station (Esso, Shell, Ultramar, etc), Motel, Depanneur, Restaurant, Resto Bar, Coffee Shop, Grocery Store, Convenience Store, Dollar Shop, Boutique Shop, Salon, etc.

Agricultural property: Agricultural land, Agricultural Farm and Agricultural Property.

It’s always better to work with a local commercial realtor to help make the process easier. We can help save time for you by helping you understand and decipher the paperwork involved in transactions such as purchasing a new property. With a commercial realtor, you get a business partner whose main objective is to help you find the right space for you and your business, at the best possible price.

Commercial and Industrial Property Appraisals

We provide free commercial and industrial property appraisals for both of the building and land. Please complete the following information and we will be in contact with you shortly.

☎ Call today at 514-654-8890 or send an e-mail at: [email protected] for any of your real estate needs !!

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info