*** New Update: Effective as of January 1, 2023, the Prohibition on the Purchase of Residential Property by Non-Canadians Act (the “Act”) prevents non-Canadians from buying residential property in Canada for 2 years.

NEW: AMENDMENTS TO THE REGULATIONS March 27, 2023

The amendments, which came into force on March 27, 2023, expand exceptions to allow Non-Canadians to purchase a home in certain circumstances. Regulations Amending the Prohibition on the Purchase of Residential Property by Non-Canadians Regulations.

NEW: AMENDMENTS TO THE REGULATIONS On February 4, 2024

The amendments, which came into force on February 4, 2024, the Government of Canada announced its intention to extend the existing ban on foreign ownership of Canadian housing for an additional two years, to January 1, 2027.

New: Key Highlights on February 4, 2024:

• The Act defines residential property as buildings with 3 dwelling units or less. This includes semi-detached houses and condominium units. The Act doesn’t prohibit the purchase of larger buildings with 4 or more dwelling units.

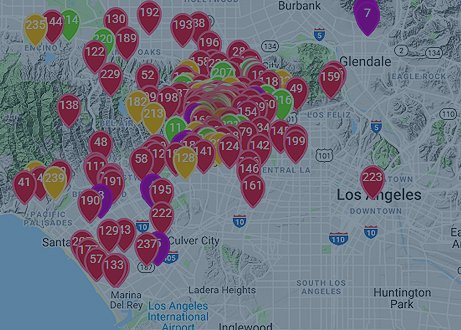

• Non-Canadians can purchase residential properties located outside of Census Metropolitan Areas (CMA) and Census Agglomerations (CA).

• Certain exceptions apply allowing Non-Canadians to purchase a residential property in defined circumstances.

• If a non-Canadian, or anyone who knowingly assists a non-Canadian, is convicted of violating the prohibition, they will have to pay a fine of up to $10,000. Additionally, a court can order the sale of the residential property.

Amendments

1. Paragraph (a) of the definition control in section 1 of the Prohibition on the Purchase of Residential Property by Non-Canadians Regulations 1 is replaced by the following:

(a) direct or indirect ownership of shares or ownership interests of the corporation or entity representing 10% or more of the value of the equity in it, or carrying 10% or more of its voting rights; OR

2. Paragraph 2 (b) of the Regulations is replaced by the following:

(b) an entity formed under the laws of Canada or a province – whose shares or ownership interests are not listed on a stock exchange in Canada for which a designation under Section 262 of the Income Tax Act is in effect – and controlled by an entity referred to in paragraph (a) or controlled by a person referred to in paragraph (a), (b) or (c) of the definition non-Canadi‐ an in section 2 of the Act.

3. Subsection 3 (2) of the Regulations is repealed.

4. Subsection 4 (2) of the Regulations is amended by striking out “or” at the end of paragraph (c), by adding “or” at the end of paragraph (d) and by adding the following after paragraph (d):

(e) the acquisition by a non-Canadian of residential property for the purposes of development.

5. Subparagraphs 5 (b) (i) to (iii) of the Regulations are replaced by the following:

(i) they have 183 days or more of validity remaining on their work permit or work authorization on the date of purchase, and

(ii) they have not purchased more than one residential property.

Coming into Force: Registration

6. These Regulations come into force on the day on which they are registered.

Q. 1. Can non-Canadians acquire vacant land?

A. Yes, as of March 27, 2023, the prohibition does not apply to vacant land.

Q. 2. Can non-Canadians purchase residential property for development purposes?

A. Yes, as of March 27, 2023, the regulations provide an exception for non-Canadians purchasing residential property for purposes of development.

Q. 3. Does the prohibition apply to properties that are purely commercial in nature (e.g. office towers or grocery stores containing no dwelling units)?

A. No, the prohibition is not intended to apply to existing property that is purely commercial in nature.

*** Sources: PROTECTED B Confidence of the King’s Privy Council SOR