Buy a Property for your family and for future investment

Are you currently renting and thinking about joining the ranks of homeowners? You should know that in addition to providing numerous financial benefits, buying a home will help improve your quality of life. Not only do homeowners enjoy more freedom, they also have a strong feeling of pride, as well as peace of mind. It’s definitely a worthwhile investment!

A Well-Adapted Home

First and foremost, being a homeowner means living in a house that suits your tastes and fits your lifestyle.

Is your family growing – do you want a backyard and basement playroom for your children? The purchase of a home can help you benefit from these extra spaces and is also a good long-term investment. Condominiums and Duplex or 4plexes offer other benefits: less maintenance in the first case and additional income in the latter.

Building Capital

Paying for a home is a bit like making long-term savings. Instead of paying rent to a landlord, your monthly mortgage payments are used to finance your assets and build capital that you will recover once you finish paying.

A Profitable Investment

Across Canada, the value of real estate investments has increased significantly over the past ten years. In Québec, the median price of a single-family home grew from $400,000 to $500,500 between 20010 and 2018. This translates into an average appreciation of 8% per year.

Taking Advantage of Fixed Payments

Tired of rent increases? Unlike tenants who must deal with these fluctuations, as a homeowner, you can enjoy fixed payments for many years and, depending on the type of mortgage you choose, protect yourself against possible interest rate increases.

A New Lifestyle

Unleash your creativity and decorate your house as you wish, without worrying about the restrictions that are imposed on tenants. Any amount invested in decoration or renovation will be for your benefit. Moreover, nobody can make you leave your home, or enter uninvited for inspection or maintenance.

Checklist for a property visit

When visiting properties, here is a checklist to help you choose one property over another. (Complete this form on each visit)

Expenses to be expected at the signing of the deed of sale

1. Notary fees

2. The distribution (refunds) of taxes: The calculation of the refund to the seller (if applicable) will be made from the date of occupancy and you will have to refund the seller for the number of days already paid by him, for the following property taxes:

3. Municipal taxes

4. School taxes

5. Oil tank а heating: If the property is equipped with oil heating, the seller must have the tank filled on the day of the deed of sale and bring the invoice to the notary, which the buyer must refund in full.

6. Electricity (Hydro-Québec) and gas (Gaz Métropolitain) meters The buyer and seller must notify Hydro-Québec and Gaz Métropolitain (if applicable) of the date of the change of ownership so that the meters can be read on that date, and so that the amounts can be charged to the buyer and seller respectively on the date the property is occupied.

7. Home Insurance: Remember that when you sign the deed of sale, you will need to provide proof that home insurance is in place for an amount equal to or greater than the mortgage in place.

Expenses to be expected after signing the deed of sale

1. Duties on transfers of immovables or “Welcome Tax”

2. The municipality in which you have moved will send you a transfer tax account within four (4) to six (6) months of signing the deed of sale, and it is calculated based on the sale price and according to the following schedule:

0.50% on the first $50,000

1.00% of 50,000 а $250,000

1.50% over $250,000

3. Moving expenses, painting, decoration, etc.

Please contact me

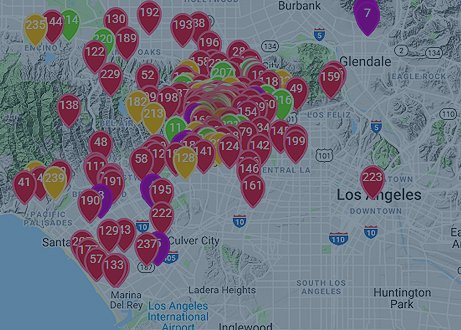

Once you have completed your needs analysis, contact me. If you move to a location very far from the large area in which I work, I can refer you to with my associate in the desired area.

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info