Welcome to New Comer or New Immigrant in Canada

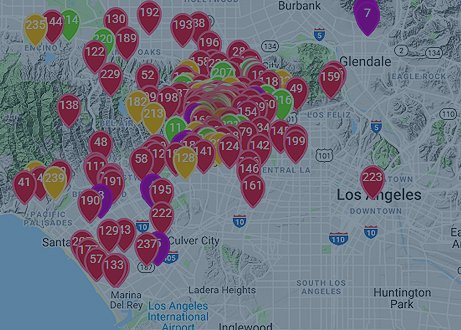

Buying a property in Greater Montreal or Quebec?

Are you a newcomer or immigrant in Canada? Are you interested in buying a home but are struggling to get a mortgage with a better rate?

When it comes to buying a home, most Canadians don’t pay the full cost of their home in a single payment (i.e. all at once).

Finding the right home to buy often takes more time and care than renting as it is considered as more of a permanent commitment.

Generally, the money needed to finance the purchase of a new home stems from two sources:

Your mortgage

This is the money you will borrow from a lender such as a bank.

Your mortgage down payment

This is the large sum of your own money that you will put to finance your home. The more money you put down, the less you need to borrow and the lower your overall interest costs will be.

It will always depend on your employment history and immigration status.

Qualified homebuyers who have immigrated or relocated to Canada within the last 5 years are eligible under the “New to Canada” program to purchase a property with as little as a 5% down payment.

General Guidelines for Home Ownership program:

- The New Immigrant Home Ownership Program is for Canadians who have recently received Canadian Immigration status and who want to own a home, but who have not yet established a Canadian credit history

Eligibility for newcomers in Canada:

Clients must:

- Be a new immigrant to Canada with a newly acquired Canadian immigration status

- Have a Permanent Resident card which shows (on the back of that card) that they became a permanent resident of Canada within the last 5 years

Borrower Qualification:

- Must have immigrated or relocated to Canada within the last 60 months

- Minimum of 3 months of full-time employment in Canada (borrowers being transferred under a corporate relocation program are exempt of this)

- Must have a valid work permit or obtained landed immigrant status (i.e. permanent resident)

- For 95% LTV (Loan-to-Value), down payment must be from one’s own resources. For LTV’s less than 95%, the remainder may be gifted from an immediate family member or from a corporate subsidy

- Income Confirmation

- Down payment confirmation

- Purchase and Sale agreement

- Letter of reference from a recognized financial institution

- OR 6 months of bank statements from a primary account

- Foreign Diplomats who do not pay taxes in Canada are ineligible for this program.

- For LTV ratios of less than 95%: customers must pay at least 5% of the down payment by their own resources, the remainder can be from a non-traditional source

- Two (2) alternative sources of credit demonstrating timely payments (no arrears) for the past 12 months.

The two alternative sources required are:

1) Rental payment history confirmed via a letter from landlord and bank statements

2) One other alternative source (hydro/utilities, telephone, and cable) to be confirmed via a letter from the service provider or 12 months billing statements

Note: The insurance premium is non-refundable, paid at the time of closing and may be added to the mortgage.

Target audience: this mortgage appeals to clients who:

- Want to buy a home but have no Canadian credit history

- Have saved enough for a down payment

In general, each program has similar requirements as what we have described above with respect to residency status, credit rating, and down payments. However, there are minor differences within each program that should be noted and which a professional will be able to help you understand. In providing these documents, we may then assist you in accessing a mortgage with as little as 5% down payments. Nonetheless, we always recommend making a larger down payment if possible.

There are different types of properties and business:

RESIDENTIAL PROPERTY: House, Condo / Townhouse / Coop, New Home, Duplex, Triplex, Fourplex, Vacation Property, Land, Chalet Water Front, Chalet / Cabin / Country House, Farmland and Chalet in Mont-Tremblant, etc.

COMMERCIAL PROPERTY: Multi-Family/Unit, Strip Mall / Plaza & Investment Property, Land, etc.

BANK FORECLOSURE PROPERTY: Bank Repossession / Foreclosure Property.

BUSINESS: Oil / Gas Station (Esso, Shell, Ultramar, etc), Motel, Depanneur, Restaurant, Resto Bar, Coffee Shop, Grocery Store, Convenience Store, Dollar Shop, Boutique Shop, Salon, etc.

AGRICULTURAL PROPERTY: Agricultural land, Agricultural Farm and Agricultural Property.

HOLIDAY HOME: Chalet / Cabin / Country house: Mont-Tremblant Resort area. It is around a one and a half (1½) hours drive from Montreal and Ottawa, Quebec, Canada.

RESTAURANT FRANCHISE: Burger King, PIZZERIA, QUIZNOS Subs, VALENTINE, SUSHI Shop, etc.

I can assist you to find Home, Business & mortgage also for New Immigrant in Canada. “Canada makes it easier for a new immigrant to get a mortgage than someone who is already established here.

For more information in details call today at ☎ 514-654-8890 or send an e-mail at info@realtyincanada.com for all of your real estate needs!!

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info