Welcome Foreign Buyers!

Have you been thinking about getting into the Canadian real estate market? For your convenience, we have put together resources and a quick guide covering the basic rules and regulation of buying a property in Montreal, Quebec, Canada (or in any other Canadian province). Foreigners can own condominiums as well as homes.

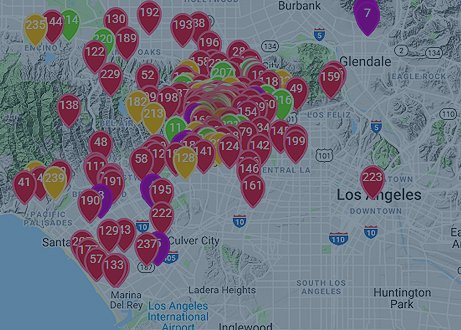

Montreal real estate is booming as more and more foreign investors are falling in love with this city and are wanting to own a piece of it. This isn’t surprising given that Montreal is the business capital of the largely French-speaking province of Quebec, and Canada’s second largest city by population.

Furthermore, Montreal has been named the world’s best city for students, beating out London, Berlin, Boston, and Tokyo in a global ranking of 125 cities. Montreal’s position is based on six rankings: the quality of the universities (McGill ranked 24th in the world and 1st in Canada in the 2016 QS university rankings); diversity of the student population (approximately 27% of students at the ranked universities (McGill and UDEM) are international).

We have helped many non-residents buy properties in Montreal, Canada and have identified some questions that come up frequently. I worked with buyers from around the world moving to Montreal from China, Russia, Hong Kong, South Korea, South Asia, Africa, South America, the Middle East / Gulf countries, Europe, United States and other countries as well.

For the International / Non-Residents Ownership:

Canada welcomes home buyers from all countries around the world and there are no limitations on the number, or kind, of real estate or business that you can buy. That being said, some banks will finance only up to 2 or 3 properties per person.

*** New Update: Effective as of January 1, 2023, the Prohibition on the Purchase of Residential Property by Non-Canadians Act (the “Act”) prevents non-Canadians from buying residential property in Canada for 2 years.

NEW: AMENDMENTS TO THE REGULATIONS March 27, 2023

The amendments, which came into force on March 27, 2023, expand exceptions to allow Non-Canadians to purchase a home in certain circumstances. Regulations Amending the Prohibition on the Purchase of Residential Property by Non-Canadians Regulations.

Amendments

1. Paragraph (a) of the definition control in section 1 of the Prohibition on the Purchase of Residential Property by Non-Canadians Regulations 1 is replaced by the following:

(a) direct or indirect ownership of shares or ownership interests of the corporation or entity representing 10% or more of the value of the equity in it, or carrying 10% or more of its voting rights; OR

2. Paragraph 2 (b) of the Regulations is replaced by the following:

(b) an entity formed under the laws of Canada or a province – whose shares or ownership interests are not listed on a stock exchange in Canada for which a designation under Section 262 of the Income Tax Act is in effect – and controlled by an entity referred to in paragraph (a) or controlled by a person referred to in paragraph (a), (b) or (c) of the definition non-Canadi‐ an in section 2 of the Act.

3. Subsection 3 (2) of the Regulations is repealed.

4. Subsection 4 (2) of the Regulations is amended by striking out “or” at the end of paragraph (c), by adding “or” at the end of paragraph (d) and by adding the following after paragraph (d):

(e) the acquisition by a non-Canadian of residential property for the purposes of development.

5. Subparagraphs 5 (b) (i) to (iii) of the Regulations are replaced by the following:

(i) they have 183 days or more of validity remaining on their work permit or work authorization on the date of purchase, and

(ii) they have not purchased more than one residential property.

Coming into Force: Registration

6. These Regulations come into force on the day on which they are registered.

Q. 1. Can non-Canadians acquire vacant land?

A. Yes, as of March 27, 2023, the prohibition does not apply to vacant land.

Q. 2. Can non-Canadians purchase residential property for development purposes?

A. Yes, as of March 27, 2023, the regulations provide an exception for non-Canadians purchasing residential property for purposes of development.

Q. 3. Does the prohibition apply to properties that are purely commercial in nature (e.g. office towers or grocery stores containing no dwelling units)?

A. No, the prohibition is not intended to apply to existing property that is purely commercial in nature.

*** Sources: PROTECTED B Confidence of the King’s Privy Council SOR

Requirements for Foreign or Non-Resident buyers of Montreal, Quebec Real Estate.

The rules regarding Non-Residents buying real estate in Canada are not actually related to citizenship – even Canadian citizens who don’t reside here for more than 180 days (or half of the year) are considered non-residents (and thus subject to the same rules).

Taxes Questions and Good news for International or Foreign Buyer in Quebec!

There are no additional taxes for non-residents when buying property in Montreal or in any other part of the province of Quebec.

Important Tax Info for Toronto Market: As of April 21, 2017, any individual who is not a Canadian citizen or permanent resident of Canada (including corporations and trusts) is subject to a Non-Resident Speculation Tax (NRST) of 15% of the purchase price (paid at closing) for properties purchased in Toronto, Ontario.

Important Tax Info for Vancouver Market: Introduced in July 2016 the tax bill initially required foreign entities (including foreign nationals) to pay an additional 15% on the purchase of residential property in Greater Vancouver. The current provincial local government increased the amount to 20% in February 2018 and expanded its reach to include the Fraser Valley, Capital Regional District, Nanaimo Regional District, and the Central Okanagan.

Financing with a bank for Foreign or Non-Resident Buyers:

- Some banks are happy to provide mortgages to non-resident buyers

- We consider a non-resident to be a person who resides outside Canada or within Canada with a valid temporary resident Visa, valid work permit or valid study permit.

- Applications must be given with appropriate identification and documentation provided:

- A reference letter from their bank

- An employment letter verifying income in Canadian or US dollars

- Bank statements for three months

- A Canadian bank account is mandatory for payments and must be opened in person prior to the funding of the mortgage.

Note: If you don’t meet the eligibility requirements, you may still be able to get financing from other lenders who charge higher interest rates.

Your business is important to me.

Thinking about investing in Montreal‘s real estate market? Contact me & Let’s happen!

I can assist with your mortgage application and answer any questions you may have.

You can find and reach me on: WhatsApp, imo, WeChat, Viber, Messenger

Emdadul Hoque, Realtor

☎ +1 514 654 8890

To learn more, call today at ☎ + 1 514-654-8890 or send an e-mail at: info@realtyincanada.com for all of your real estate needs.!

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info