Selling the property as a foreigner or non-resident

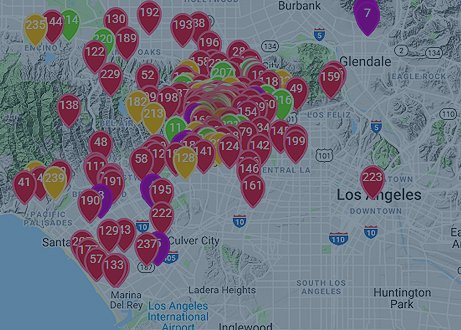

At the time of selling your home, we could represent the foreigner owner as a seller’s realtor/agent. This website acts as a platform to effectively showcase your property to the rest of the real estate market. With our expertise in technology, marketing, and social media, we aim to increase online exposure of your home to sell it as quickly as possible.

If you are thinking of selling a home, condo or other real estates in the Montreal area, we will market the property through the following means:

- Determine the right price property based on market and the overall real estate market, supply and demand, and what other similar properties have sold for in the same condition.

- Market property through multiple channels to both domestic and international buyers

- Leverage online exposure of property using our media platform’s popularity

Marketing Strategy:

- In-person visits to the property with potential buyers/their agents

- A convincing presentation of property’s upsides

- Professional photography

- Professional floor plan

- Google marketing

- Website marketing (Multiple websites, Broker system, etc)

- Social media marketing (Facebook, Twitter, etc)

- Open houses for previews for Brokers

- Open houses on Sundays catering to buyers

- Media interviews at the property (as opportunity permits)

- Broker/potential buyer exposure events at the property (as opportunity permits)

4. Ministère du Revenu du Québec (MRQ) Quebec Refer to TP-1097 V exchange sources for owners who wish to defer tax payments by exchanging to a like-kind investment property. This is an effective portfolio building strategy.

5. The seller would pay broker fee to market the property. This fee, usually 4-5 % of price plus local tax GST/HST and QST/TPQ, would be split between brokers from both sides. Despite fees coming from the seller, the buyer’s broker represents the interest of the buyer; the seller’s broker represents the interest of the seller. The other costs for the seller is another 0.20% (or notary / lawyer will inform you the amount) of the price, driven by the property transfer fee (which seller pays). You can show these total fees and expenses when performing your personal income taxes.

6. Canada Revenue Agency (CRA)Tax form IC75-6R2 or T2062 Required Withholding from Amounts Paid to Non-Residents Providing Services in Canada.

7) For sellers who are foreigners, there is a withholding tax called IC75-6R2 (Foreign Investment In Real Property Tax Act) equal to 25 percent of the sale price. This is refundable and is basically the Canadian government’s way to ensure a foreign property owner is up to date on taxes that were due. If the foreign property owner has been reporting taxes annually, the attorney could also request for a IC75-6R2 exemption.

To learn more about it, Contact us!

You can find and reach me on: WhatsApp, imo, WeChat, Viber, Messenger

Emdadul Hoque, Realtor

☎ +1 514 654 8890

Call today at ☎ + 1 514-654-8890 or send an e-mail at: info@realtyincanada.com for all of your real estate needs.!

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info