Are you looking to save more from your mortgage and cashback?

I am a mortgage professional, residential and commercial, in the Greater Montreal area, Laval, South Shore, and surrounding areas. The more you know about the mortgage process, the better it is for you. Using our services will enable you to access a wealth of mortgage information and helpful tips. As a mortgage professional, I can assist with your mortgage application and answer any questions you may have.

More you save and more you grow with a mortgage and refinance.

A First Step: To getting pre-qualified for a home mortgage or loan is an essential first step in the buying process. Find out exactly how much you can afford for a home-based on your income, debt, and other factors. It can also help you lock in a good interest rate, and it puts you in a stronger bargaining position with the seller of the home you ultimately choose.

Mortgage Solutions – Bad Credit, Fixing Credit

So, what do you do if your credit reports make you want to hide under the covers and never use your credit cards again? Don’t worry, you can turn your ratings around.

Mortgage lenders look at the “age,” dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and not paying on time can impact your credit score negatively. However, if you make the effort to change one of these components of your spending behavior, this can positively affect your credit score. Also, keep in mind that while bad credit does not necessarily mean that you cannot get a mortgage, it does mean that it will come at a higher cost.

There are ways you can improve your credit score such as paying down your debts, paying your bills on time and disputing possible errors on your credit report. However, on the flip side, there are also ways that you can hurt your score. So remember:

- DON’T close an account to remove it from your report (it doesn’t work).

- DON’T open too many credit accounts in a short period of time.

- DON’T take too long to shop around for interest rates. Lenders must pull your credit report every time you apply for credit. If you are shopping around with different lenders for a lower interest rate, there is generally a grace period of about 30 days before your score is affected.

Why Me?

If you are having difficulty getting a loan, ask your lender why that is. Chances are that it will be one of the following reasons:

- Failure to pay a previous or existing loan: If you have defaulted on other loans, a lender will think twice.

- Overextended credit cards: If you miss payments or exceed your limit, that’s a red flag to lenders.

- Bankruptcy: Filed for bankruptcy in the past seven years? You might have trouble getting a loan.

- Overdue taxes: Lenders check your tax payment record.

- Collection agencies: Lenders will know if collection agencies are after you.

- Legal judgments: If you have a judgment against you for a given situation (e.g. having delinquent child support payments) it could harm your credit.

- Overreaching: You might be seeking a loan outside of what you can reasonably afford.

Note: If you don’t meet the eligibility requirements, you may still be able to get financing from other lenders who charge higher interest rates.

MORTGAGE AND LAND TRANSFER CALCULATOR

Mortgage Calculator

This calculator has been placed at your disposal to help you calculate the amount per month you would pay for your mortgage in Quebec.

[mortgage_calculator]

Your business is important to me.

As a mortgage broker specializing in residential and commercial, I can assist with your mortgage application and answer any questions you may have.

To learn more about it call today at ☎ 514-654-8890 or send an e-mail at info@realtyincanada.com for all of your real estate needs !!

Mortgage Calculator

Mortgage Calculator Text EN

Mortgage Calculator Text ENExclusive features

Exclusive features Text EN

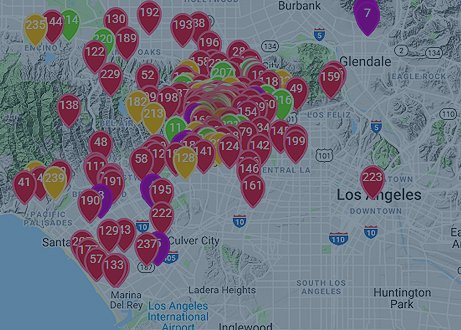

Exclusive features Text ENSign up now for live access sooner: 100% more listing info, new listings, save your searches & more.

Sign Up Now!Home Evaluation

Home Evaluation Text

Home Evaluation TextCurrent market trends and home sales gives you an accurate analysis and how much is your home worth? Looking to sell?

More Info